Industry News

Home / News / Industry News / The high and low voltage control cabinet market will exceed 150 billion yuan by 2025, driven by intelligent technology and new energy.

According to data from the National Energy Administration and the China Electrical Equipment Industry Association, the market size of high and low voltage control cabinets in my country exceeded 120 billion yuan in 2023 and is expected to surpass 150 billion yuan by 2025, with a three-year compound annual growth rate of 8.5%-11.5%, indicating structural growth in the industry.

New Energy Becomes Core Growth Driver

Under the "dual-carbon" strategy, the new energy sector has become the main driver of growth. In 2023, the market size of photovoltaic supporting control cabinets exceeded 24 billion yuan, a year-on-year increase of 31%; the procurement volume of offshore wind power high-voltage ring network cabinets increased by an average of 28% annually. The energy storage and charging pile sectors are developing in tandem. In 2025, the market for control cabinets for energy storage converters will exceed 4 billion yuan, and the growth rate of control cabinets for charging piles will exceed 45%.

Intelligentization Accelerates, Showing Premium Value

In 2025, the penetration rate of digital intelligent control cabinets will reach 45%, doubling compared to 2021. The premium for intelligent products is 2.3 times that of traditional products. Energy-saving control cabinets equipped with AI algorithms can optimize energy consumption by 15%-22%, and the related market exceeded 9 billion yuan in 2023. Driven by policy, the industry's R&D expense ratio rose from 2.8% in 2020 to 4.1% in 2023.

The regional and competitive landscape is distinct. Regionally, East China leads in growth, with Jiangsu, Zhejiang, and Shanghai accounting for 38% of the national high-voltage switchgear procurement. The western new energy base drives demand, with Inner Mongolia and Xinjiang experiencing growth exceeding 29%. Guangdong accounts for 67% of the bidding for intelligent low-voltage switchgear. In the competition, Chint and Delixi hold 47% of the low-voltage switchgear market, while foreign companies such as Siemens monopolize over 60% of the high-end high-voltage switchgear market. Domestic companies saw a 31% increase in exports in 2023. Challenges and opportunities coexist.

Rising copper prices and high reliance on IGBT imports are squeezing profits, but the new energy sector and data centers are expected to grow by over 25% in the next three years. Companies that focus on high-end products and capitalize on the opportunities presented by ultra-high voltage power transmission are poised for growth.

The variety of models, to meet the development needs of various regions in the world.

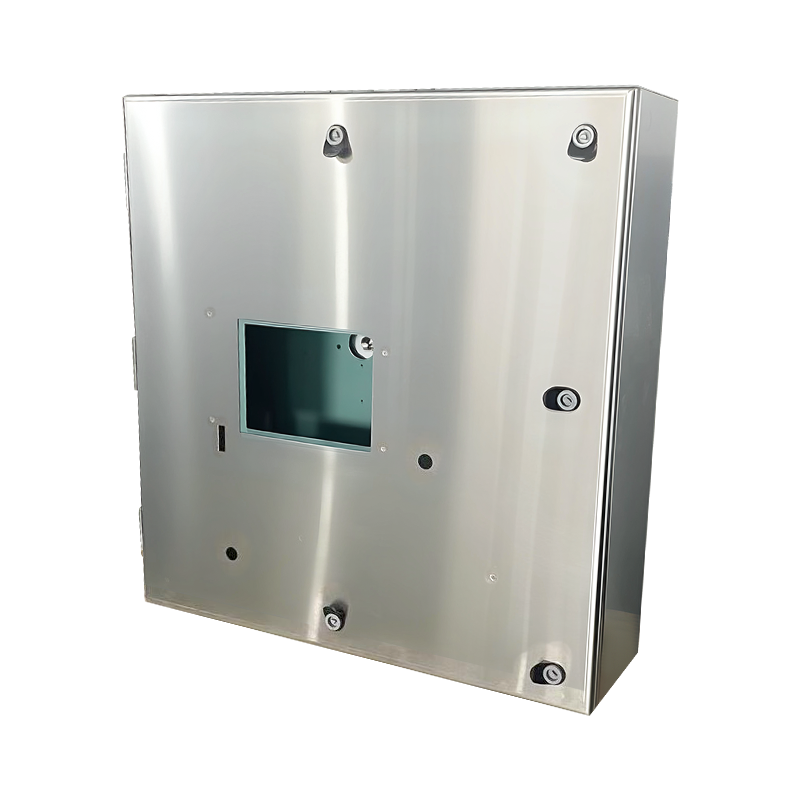

Carbon steel spray-coated AE electrical box

Non-standard carbon steel spray-coated custom cabinet

Non-standard customized mobile control panel

Phone:+86-15896481972(zhuxiaosui)

Fax: +86-0510-83890571

E-Mail: [email protected]

ADD:No. 2 Qida Road, No. 1 Shunqi Road, Yuqi Street, Huishan District, Wuxi City, Jiangsu Province, China